Our Services: Tax Preparation

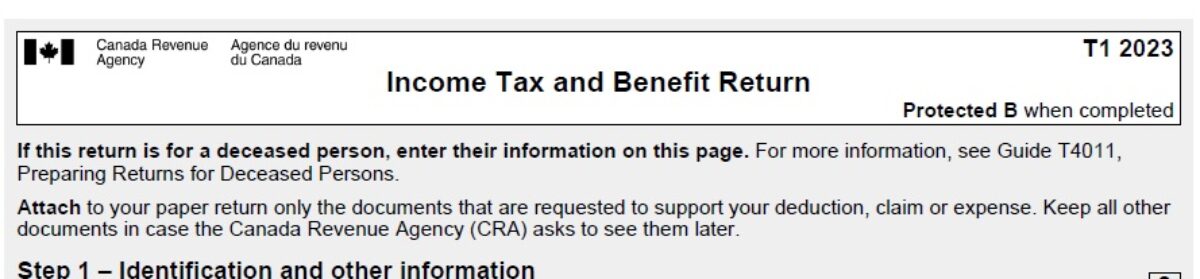

Let Us Prepare Your 2020 Personal Taxes. We offer convenient, accurate, and affordable preparation of all types of tax returns. We’re equipped to handle any tax situation, including personal returns, rental properties, estate/trust, U.S returns, corporations, and more. We’ll make sure that you get the maximum refund possible, and we provide you with tax support after the tax returns are filed.

Just follow these simple steps:

1. Collect your tax information

See our Tax Check List for the tax information required and send this information via one of the (5) options below. If you are not sure on the information required – just contact our office and we will be happy to assist you.

- Request invitation to our portal https://www.expert-fiscaliste.org/expert-fiscaliste-portal/

- Electronic information attachments via email to:will@expert-fiscaliste.ca

- Dropbox/File Share/One Drive: share with will@expert-fiscaliste.net

- Paper information via fax to: 877-720-7086

- Paper information via mail to: Expert Fiscaliste: 1000 de La Gauchetière Ouest, 24th Floor, Montréal QC H3B 4W5

Please send in all copies of your receipts, do not detach slips or use staples. We will electronically scan your tax information and return all tax receipts and information to you.

2. We will calculate your taxes

3. Your final review, signature, and closing of the taxation year

About Expert Fiscaliste

Expert Fiscaliste provides Canadian and international income tax preparation and consulting services to individuals, businesses, and trusts.

If you want to take advantage of our services for your Tax Return. Give us a call at 514-954-9031, or visit our Contact Tax Experts page.