T1 Returns Filed Before September 1st Exempt From Late-Filing Penalties

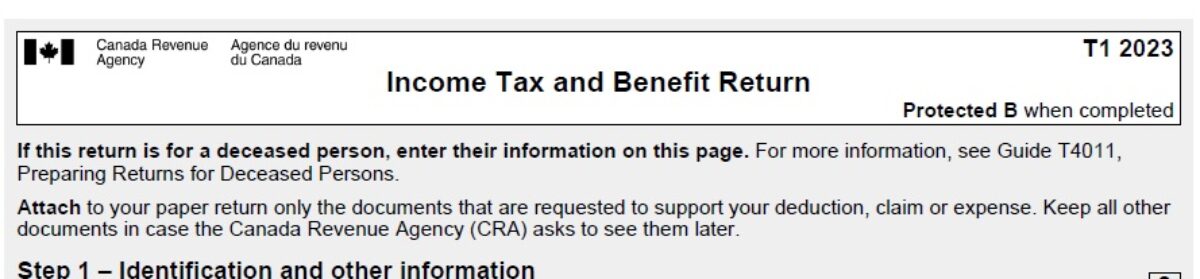

The CRA has effectively deferred the due date to file a personal tax return by another three months. Previously, the CRA extended the deadline for most individuals (other than self-employed) to file their 2019 return to June 1, 2020. The deadline for a self-employed individual, their spouse, or their common-law partner continues to be June 15, 2020. In either case, the deadline to pay amounts owed was extended to September 1, 2020, so interest and penalties would not be applied so long as any balance owing was paid by this date.

On May 22, 2020, the CRA further clarified that the late-filing penalty will not be applied for a return filed after the June 1, 2020 deadline as long as both the return is filed and payments are made by September 1, 2020. Without a late-filing penalty, taxpayers are free to file their returns late without consequence, provided that the return is filed and the balance owing is paid by September 1, 2020.

Does this mean that it’s good idea to file a T1 return late in June, July, or August? This might not necessarily be the case. The CRA is still seeking personal returns from individuals by June 1, 2020 in order to ensure accurate federal and provincial benefits payments. However, as a temporary remedy for late-filed returns, the government will continue to pay benefits for the July, August, and September, using the information from an individual’s 2018 return if they have not yet filed their 2019 return.

And as usual, if an individual is expecting a big refund, there is little reason to delay filing their return since filing sooner puts that refund money in their pocket sooner.

About Expert Fiscaliste

Expert Fiscaliste provides Canadian and international income tax preparation and consulting services to individuals, businesses, and trusts.

If you want to take advantage of our services for your 2019 Tax Return. Give us a call at 514-954-9031, or visit our Contact Tax Experts page.